Categories

July 15, 2020

Disruption in Marketing Research: Why Full-Service Agencies are Under Threat, and How They Need to Respond

A look into how to keep research up to par with digitization.

Understanding Disruption

The marketing research industry has already seen some disruption, but nothing compared to what some industries have had to face. More disruption is likely. Being ready for it means defining the possible threat.

One possible starting point for understanding disruption is Aggregation Theory, popularized by Ben Thompson of Stratechery. Aggregation Theory ‘provides a framework to understand the impact of the Internet on nearly all industries… to both understand opportunities for startups as well as threats for incumbents’.

To provide an example of how Aggregation Theory helps to explain disruption in the car services industry: ‘Previously, taxi companies integrated dispatch and fleet management. Uber modularized fleet management by working with independent drivers. Uber is integrating dispatch with customer management, enabling it to scale worldwide.’

In other words, if we want to understand disruption, we should ask ourselves, ‘how do incumbents currently differentiate, and can some aspects of that differentiator be digitized?’

To answer this question, this article:

- Explores the status quo, including how incumbents currently differentiate, and which incumbents may be most likely to be disrupted

- Explores key industry trends to identify what differentiators could, or will, be digitized

- Suggests a way forward for incumbents

1. How incumbents currently differentiate

The research industry essentially has 4 ‘layers’:

- Research participants — the raw material for research

- Suppliers — the individuals/agencies who specialize in particular aspects of a research project (e.g., translation, recruitment, transcription)

- Distributors — full-service research agencies, who integrate all research services into one offering, whether they deliver the service themselves or just re-sell a supplier’s service

- Research buyers — clients, whether brands or agencies. The people who pay suppliers/distributors

Instinctively, the distributor layer — i.e., the full-service agencies — is the one that is most under threat. After all, in many disrupted industries, it has been the ‘integrators’ and ‘distributors’ who have been impacted the most (think taxi dispatchers, newspaper publishers).

Of course, just because a category of provider could be disrupted, doesn’t mean it will be. So let’s look at full-service agencies in more detail.

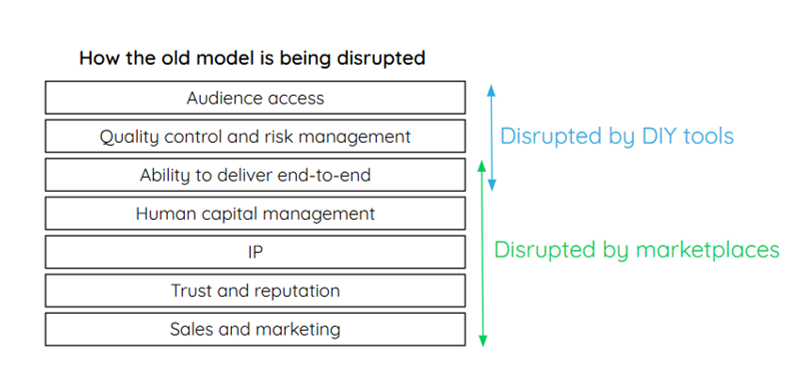

The full-service business model has been the same for many years. Agencies differentiate by integrating several different ‘services’ to research buyers:

- Audience access — agencies either have proprietary respondents panels or lists, or they have a network of suppliers they can tap into to recruit research respondents. Either way, agencies have historically given research buyers the ability to get audience access more efficiently than if they tried to do it directly themselves

- Ability to deliver end-to-end — full-service agencies’ ability to provide a research project end-to-end saves clients time. Rather than having to manage multiple suppliers, a client can get one company to manage the process and therefore save time. That company may be white-labeling independent suppliers or delivering services in-house, but either way, they are taking responsibility for delivery and project management

- Quality control and risk management — there are a lot of moving parts on any research project, and there is a lot of opportunity for issues and errors. For example, an external supplier could send confidential information to the wrong inbox, or data might be misreported. A research agency offers processes and structure to ensure no issues, and to reduce the client’s risk

- Human capital management (in other words, talent acquisition and retention, training and career development, resource planning) — full-service agencies offer easy access to a high-quality pool of research talent. Traditionally, if a research buyer wanted to find a well-trained, trusted survey programmer as well as a qualitative moderator and a talented qualitative recruiter, they’d have to spend a lot of time to identify and onboard those individuals, whether as full-time employees or contractors

- IP — research agencies have a series of processes that they develop and use to ensure research projects are of high quality, and efficient. Also, they have extensive experience in executing research and can use that knowledge to preempt errors and to improve the quality of the process

- Trust and reputation — by hiring an independent 3rd party agency, research buyers have traditionally been able to ensure that the research process and findings are more trusted than research conducted in-house. That is particularly true for agencies with brand recognition among the business population. A report from Famous Research Brand Inc. can carry particular weight internally

- Sales and marketing — full-service agencies invest more in sales and marketing than most specialist suppliers, which gives them an advantage in developing direct relationships with research buyers

The point about ‘end-to-end delivery’ is particularly important. Most research agencies tend to sell ‘monolithic’ projects, in which they bundle together all of the different steps of a project into a single package.

While this bundling is, in theory, more convenient for the research buyer, it can often reduce transparency and collaboration between the agency and the client.

For example, I have heard from many research buyers who have reported the following experience. They brief an agency, approve a questionnaire or interview guide, hear from the agency a small number of times during the project with general updates, and then get given a final report, which is very generic and doesn’t meet their needs.

To answer this question, we need to look at two trends. Both may not seem particularly relevant to the research industry right now, but our view is that they will be the key drivers of industry disruption.

A. The rise of D.I.Y. tools

The last decade has seen a proliferation of self-service tools that marketers can use to do their jobs more effectively, such as Google Analytics, Hootsuite, WordPress.

Naturally, this trend has extended to the marketing research industry. There are D.I.Y. tools for most steps of a research project, such as survey creation and distribution (e.g., Confirmit); quantitative recruitment (e.g., Lucid); qualitative recruitment (e.g., respondent.io); analysis and reporting (e.g., Qualtrics); visualization tools (e.g., Tableau).

Research buyers increasingly expect to be able to conduct specific research tasks themselves. That obviously threatens full-service agencies’ tendency to sell monolithic projects. Clients want to be more hands-on, and they increasingly want a more transparent and collaborative experience.

D.I.Y. tools, therefore, threaten three aspects of the full-service offering:

- Audience access — tools like Lucid, Cint, Qualtrics, and respondent.io already let research buyers quickly access potential respondents directly. As these tools become easier to use, and as more solutions come to market, it will be more difficult for full-service agencies to justify their role as an intermediary

- Ability to deliver end-to-end — as mentioned above, pretty much every step of the research process is possible through D.I.Y. tools. While research buyers may not have the time or inclination to do an entire research project in-house, they may choose to conduct specific steps in-house. As a result, full-service agencies won’t be able to sell monolithic projects any more

- Quality control and risk management — useful D.I.Y. tools have features that replicate many of the quality control steps that research agencies would have taken. As a result, in-sourcing won’t impact quality control or risk as much as it might have in the past

B. The rise of marketplaces

Many freelancer marketplaces currently focus on shift work (e.g., Wonolo, UberWorks). Some match buyers and providers of professional services, such as front end development, graphic design, market research (e.g., UpWork, Toptal).

There are also agency ‘marketplaces’ like Clutch.co and UpCity, which are mostly traditional directories with a few ‘bells and whistles.’

Very few research buyers are currently present on these platforms, but that is starting to change as marketplaces become more normalized, and as more suppliers join these platforms.

These marketplaces should allow research buyers to efficiently work directly with suppliers, getting cost-effective services from trusted experts without spending a lot of time managing them.

For example, let’s say that a client wanted to conduct an international survey. Marketplaces should allow them to find, onboard and manage the following relatively easily:

- A consultant to write, or help with, the questionnaire

- A survey programmer who can create the survey website and, if required, launch and manage it

- A foreign-language speaker who can translate the questionnaire

- A consultant who can analyze the results and help to build a presentation

As a result, marketplaces threaten many aspects of the full-service offering:

- Ability to deliver end-to-end

- Human capital management — if it is a lot easier to identify a talented survey programmer and a skilled qualitative moderator on a marketplace, there’s less need to use an agency that has access to them all in one package

- IP — businesses may own IP, but individuals do the actual implementation. If research buyers can find the right individuals on marketplaces, they should still benefit from the IP

- Trust and reputation — on marketplaces, reviews and ratings are the primary way to establish a reputation. Individuals and agencies who are well-established on marketplaces are likely to have many positive reviews, and be highly trusted, even if they aren’t an agency that has won awards and delivered thousands of projects

- Sales and marketing — marketplaces have the effect of commoditizing services, and of reducing the power of brands. For example, many of the biggest brands on Amazon.com are not brands at all: https://www.nytimes.com/2020/02/11/style/amazon-trademark-copyright.html. Full-service agencies’ current sales and marketing efforts will have limited success on marketplaces against agencies or individuals who have more reviews or are cheaper

3. A way forward?

We think full-service research agencies need to re-think how they work with clients in a few ways.

First, there needs to be a reduced reliance on selling ‘monolithic’ projects. Some clients may continue to want end-to-end project delivery, but agencies will also need to offer a modular delivery model that allows clients to purchase specific steps of the research process.

For example, a client with a Qualtrics license may just want its agency to write the questionnaire and conduct the analysis.

Second, there needs to be greater collaboration and transparency at each stage of a project. That should allow clients to be more hands-on, and to prevent situations where the agency delivers insights that don’t match what the client wants.

To give examples of what that might look like:

- Allowing clients to write the first draft of questions, and then just suggesting changes that ensure best practice

- Involving clients in the analysis process from the very first stage, allowing them to become part of the research team

Third, agencies need to be a ‘coach’ to clients and to be more transparent in sharing their IP. Research buyers increasingly want to ‘self-serve,’ but researchers tend to think that it’s not in their interests to up-skill clients, as they’ll be doing themselves out of a job.

Agencies will need to be willing to play the role of an advisor on projects (“here’s best practice on X”). They may also need to offer training to insights or marketing professionals who want to understand how best to perform a specific task.

These three changes represent a significant shift in how agencies work with clients. To enable this shift, agencies need to consider changes to their overall business model. A lot is still uncertain, but here are some thoughts on what this could mean:

- More flexible pricing. A more modular delivery model requires more modular pricing (e.g., pricing by stage). Charging for time may become the dominant pricing method

- More retainers. Traditionally, agencies have worked with clients on a project-by-project basis. In other words, agencies and clients agree on project scope and fee. Then the agency executes it and invoices for the project. The project-by-project model will continue to be necessary, but we think it has its limitations. For example, it doesn’t allow clients to ask an agency for help with a few smaller tasks (e.g., editing a survey, answering a best practice question, doing some training). My agency, Adience, is increasingly starting to rely on retainers to cover these small tasks or modular activities

- Focus on ‘value add’ roles. Many full-service agencies have in-house operational teams that can focus on delivering ‘commoditized’ tasks such as transcription and survey programming. The current integrated service model means that this approach makes sense — in-sourcing allows for a better profit margin than outsourcing. A move to a modular delivery model will force these in-house teams to compete against low-cost specialists on marketplaces. And because full-service agencies tend to have a lot more overhead than specialist suppliers, it will be hard to compete. Ultimately, it may make more sense for future ‘full-service’ agencies to focus on delivering tasks that are more value add — questionnaire design, analysis, visualization, etc.

For more, visit https://www.hello-adience.com

This article was originally published on Medium.

Comments

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

Disclaimer

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.