Categories

Is Rogue IT the New Normal?

Is Rogue IT the New Normal?

If you follow technology news, as most of us do, you would have recently seen numerous articles and discussions on the growing power shift from traditional IT toward lines of business (LOBs). The common theme is that the role of IT is changing rapidly—perhaps even disappearing—as LOBs themselves buy and implement applications such as CRM, business intelligence and e-commerce by using readily available cloud-based tools. Anyone with a credit card and minimal IT experience can now purchase infrastructure on a per-use basis, set up a remotely-hosted solution stack and have a team on the other side of the world develop a custom application.

This increased involvement in—and control of—IT decisions by LOBs is a growing trend and one that industry analysts are covering with great interest. Gartner predicts that end-users, not IT, will be responsible for more than one-quarter of new business applications built this year. CA Technologies goes further, saying that LOBs are already responsible for one-third of applications. IDC believes that in just a couple of years, more than 80% of new IT investments will directly involve LOB executives, with LOBs being the lead or sole decision-makers in at least half of these. In short, what we once considered “rogue IT” is rapidly becoming the new normal.

Implications for Market Research

Some might argue that the decentralization of computing power is nothing new, but instead an ongoing evolution since the very early days of IT. We saw it with the growth of the PC when computing power moved from traditional mainframes to the desktops of users, and, more recently, we have witnessed an even further devolution with the rapid uptake of mobile devices. The advent of cloud computing is surely just another evolutionary step on this continuing march.

Not quite. Cloud computing represents a critical juncture—the proverbial first fish emerging from the ocean, if you will—as it marks the moment when LOBs move beyond being mere users, to becoming buyers, creators and owners of IT assets. This means that LOBs are taking on roles that have typically fallen outside their traditional sphere, such as solution evaluation and vendor selection.

If that is the case, what are some implications for market research? When we conduct tech-centric research studies, are we still approaching the right target audience? Should we be looking beyond the traditional IT roles (ITDMs, developers, etc.) and doing more of our research within the LOBs themselves?

Too Early for Last Rites

There are clear and obvious examples where the inclusion of LOBs within the tech research process is important. Research regarding a new CRM feature, for example, should surely seek input from key players such as CMOs and VPs of sales. And when the technology in question is newer and/or more innovative—such as PaaS, mobile payments or 3D printers—there is likely to be strong LOB involvement in the purchase process as well. After all, while 80% of a typical IT department’s budget is used to keep things ticking and only 20% goes toward incremental improvement, other business functions routinely devote up to 50% of their tech spending on innovation.

But to misquote Mark Twain, the reports of IT’s death are greatly exaggerated. Not only does the average IT department still manage the lion’s share of the technology budget (and will for years to come), but it also remains absolutely crucial to the success of technology projects in areas where LOBs currently lack expertise and may never attain it.

The Crucial, Enduring Functions of IT

The first crucial area is the actual purchase process, which typically includes the following steps:

- Maintaining awareness of technology and industry trends

- Creating and reviewing business strategies

- Developing and reviewing technology architecture

- Specifying solution requirements

- Establishing vendor/product short lists

- Evaluating and selecting vendors

While LOBs are more involved in steps 2, 4 and 6 than ever before, managing the overall process is outside of most business functions’ capabilities. The CMO is focused on the returns from a recent national promotion and doesn’t (and shouldn’t) have time to keep up-to-date on the merits of Dart vs. JavaScript. Similarly, the head of new business development might be aware of the database that underpins the reams of sales figures he looks at daily, but he ought to be the first to tell you that he’s not the right guy to architect the new Hadoop cluster. It’s a case of horses for courses—IT has the experience and the directive for day-to-day involvement in these steps. LOBs have neither, and to change that would not only undermine their core functions, but place their core business goals in jeopardy.

The second area of crucial involvement for IT is in post-purchase operations and the more mundane functions that accompany the day-to-day management of technology. The implementation and integration of systems and applications remain key roles: Even in the world of cloud, somebody needs to ensure that Salesforce plays nicely with the old SAP financial system. Then there’s the ongoing support of it all, not to mention managing governance, compliance and the very important issue of security. While LOB executives certainly want to be more involved in the process to ensure that solutions meet their needs, few are raising their hands to tackle the daily tedium of these tasks.

The Real Shift: Less Power, More Partnership

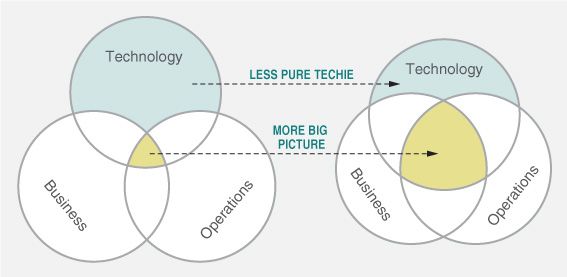

In reality, what we have is less of a power shift and more of a partnership shift. Per the diagram below, the different enterprise functions have always had to work together, for good or for bad, to get things done. Just as LOBs have relied on IT, so too has IT relied on the user base to define its needs as well as relied on areas such as Finance to approve and fund its decisions.

What’s changing is that the evolution of technology and the increased empowerment of LOBs are forcing a more collaborative environment. No longer is it within IT’s power to maintain exclusive control as a semi-discrete organization. Nor can companies afford to operate with this model anymore, when IT is a core enabler of so many strategic business functions. To remain relevant, IT needs to adapt, stand on its acknowledged strengths and act as a crucial but non-exclusive player in the design, purchase, implementation and support of business’ critical technology. In short, it has to become less “pure techie” and more “big picture.”

For us as market researchers, this should prompt a rethink of our approaches but not a radical redesign of our methodologies. We need to acknowledge the increased role of LOBs as change agents and examine where and to what extent this empowers them within the decision-making processes. Based on this, we might well choose to include them in some of our future tech research studies. But the reality is that, in most cases, IT remains the heart of the decision-making process, not the least because of its directives, experience and day-to-day responsibilities. And more so than in the past, IT should be able to clearly articulate the business imperatives that drive its priorities and actions. Based on what we’re seeing, we believe traditional IT audiences for technology research are, and will remain, as relevant as ever.

What do you think? Email me or call me at 678.799.7375.

This content was originally published by Market Strategies International . Visit their website at www.marketstrategies.com.

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.