Categories

June 1, 2020

Company Size Matters: The Differential Impact of COVID-19

A deep dive into the very different experiences of the MRX community during COVID-19.

In April and May, NewMR ran two waves of a study (each with over 1000 responses) looking into how market researchers are coping with the pandemic crisis. You can read the report and watch a recording of our presentation of the findings here.

In this post, I take a deep dive into the very different experiences of sole-traders, people in small companies, and those in organizations with more than 100 people.

Although we used several categories of company size in our study, three distinct groups/patterns emerged. These three are: the sole traders/freelancers, people in companies ranging from 2 to 99 employees, and people who work for companies with 100 or more employees. To aid clarity, we have grouped the reporting in this post by these three units, and we shall call them sole traders, small companies, and larger companies.

96% of the people working for larger companies said they were working from home, 3% said they were not working (e.g. furloughed). People working for small companies were similar to the larger companies, with 88% working from home, and 6% not working. The sole traders reported that 75% of them were working from home, but 22% of them were ‘not working’.

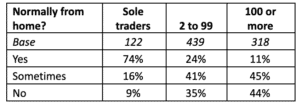

In Wave 1 we asked whether people normally worked from home. 74% of the sole traders normally work from home and 90% sometimes or regularly work from home. By contrast, only 11% of the people working for larger companies normally work from home, and 24% of the people who work for smaller companies said they normally work from home. One big question going forward is whether we will see big changes in the larger companies making working from home more ‘normal’?

Change in Hours Worked?

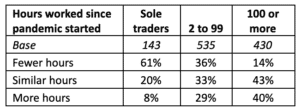

In Wave 2 we asked people whether the number of hours worked had changed since the start of the pandemic. We received three very different sets of answers, based on company size. People in the smaller companies were fairly evenly split, with approximately one third saying more hours, the same hours, or fewer hours. Among the sole traders nearly two-thirds saying they were working fewer hours, and only 8% were working more hours. In contrast, people in the larger companies reported that only 14% of them were working fewer hours and 40% of them were working more hours.

Income Disparities

In Wave 2 we also asked what changes people had seen to their income since the start of the pandemic. For Sole Traders this will tend to be a hybrid combination of personal income and trading income, for employees of larger organizations, this will tend to just be personal income. The data showed some big differences in terms of income changes and the size of the company.

For those working for larger companies, roughly two-thirds have seen their income stay the same, and one-third had seen it drop. In the smaller companies, the split was closer to 50/50 split between those seeing incomes falling and those seeing them hold steady. However, for the sole traders, over three-quarters reported that their income had fallen.

In Summary

The big picture is that sole traders (as a group) have been the hardest hit, more of them have seen a reduction in income and more are not working. Life has not been easy for others either. In the larger companies, the ones who have still got a job are often working long hours for the same or less pay.

The sole traders are the smallest group of people in the research industry, most people work in large agencies, and the small to medium-sized agencies are the next largest source of business and employment. But the freelancers do some of the most important jobs, their number includes the freelance moderators, the recruiters, the interviewers, the translators, and the marketing science, consultants. The insights and research industry needs to do what it can to protect this very vulnerable but essential part of the insights ecosystem.

A Note About the Study

Two waves, Wave 1, 29 March to 3 April, N=1014, Wave 2, 25 April to 8 May, N=1153. Responses were received from 79 countries (17% USA, 17% UK, 10% India, 7% Australia, 6%, New Zealand, 5% Canada, 4% Spain, 34% Rest of the World. The study was anonymous, and the links were distributed by NewMR and a wide range of partners, including GreenBook, ESOMAR, RANZ, The Research Society, and the Insights Association.

Comments

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

Disclaimer

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

More from Ray Poynter

Word Cloud Plus Extracts Hot Buzz Topics

The GRIT data collected toward the end of 2022 included 918 open-ended replies to the question “Related to insights, research, or analytics, which top...

Observational Data Has Problems. Are Researchers Aware of Them?

Observational data is a tempting shortcut for insights but researchers must consider its potential shortfalls

Want it Faster, Cheaper, Better? Then You’d Better Sign Up to Prescriptive Analytics

Using Prescriptive Analytics to navigate the data-filled world.

Looking at Market Researchers and Insight Professionals Through a Human Lens

A look into the MRX industry and the effect of COVID-19.

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.