Categories

January 12, 2022

Market Research During Times of Inflation

How can market research & businesses adapt to inflation?

Inflation has been a concern through 2021. We asked subscribers to the Conjoint.ly newsletter (mostly marketers and researchers) what their companies were doing in response. 36% reported that price hikes were on the horizon in May. When surveyed again in August, 43% reported that a price hike had actually taken place.

In October, the US Bureau of Labor Statistics published the 12-month inflation rate of 6.2%, the highest since 1990. In the UK, the inflation rate hit a 10-year high of 4.2%, and 4.1% for the Eurozone.

This article will walk you through the implications of all this for the world of market research and how businesses can react to inflation in general. You can also catch up on the basics of the current inflation wave in the accompanying guide on the Conjoint.ly blog.

Three implications for market research

Rising inflation will affect all industries, including market research. Three implications of inflation on the market research industry are as follows:

1. Historical data becomes less relevant

With volatile and rapidly changing preferences during inflationary periods, historical data and past research become less relevant. Businesses need to perform market research more regularly to understand current consumer preferences, sentiments, and attitudes.

2. Understanding individual segments is more important than ever

High inflation impacts each part of your customer base differently. In fact, consumers are increasingly in disagreement with each other on the basic expectation of whether inflation will continue or turn into deflation next year.

With such fundamentals in flux, one practical tip is to include a Likert scale question about inflation expectations into your segmentation, U&A, or pricing study:

Answers to this question can be used for subgroup analysis to compare preferences and price tolerance or in cluster analysis for segmentation.

3. Setting correct prices for products is important, but trickier now

Naturally, consumers become more price-sensitive during periods of high inflation, and their price references shift. For your next research project, we suggest two tips to gauge if consumers’ reference prices have already shifted:

- Test against products from adjacent categories.

- Include a Likert scale question about the perception of recent price changes.

What research will help?

Next, let’s dive into research strategies that can help you manage the rising tide of inflation.

1. Discover your current consumer sentiment

The current economic situation is changing rapidly. High uncertainty also means high volatility in consumer sentiment.

Businesses can plug into the Conjoint.ly omnibus survey to get fast, first-hand data on consumer attitudes that matter specifically to their businesses.

2. Re-measure acceptable price ranges and willingness to pay

Research has found that buying behaviours are significantly different from normal market conditions during financial crises and high inflation. Thus, previous data may become obsolete when predicting responses to price hikes.

Pricing research methodologies like Van Westerndorp’s Price Sensitivity Meter and Gabor-Granger enable marketers to re-establish the acceptable price range and willingness to pay.

3. Re-check brand preferences and attribute importances

Economic and psychological changes induced by inflation can lead to a shift in brand preferences. The order of attribute importance, especially price and emotional benefits, may also change when high inflation erodes the purchasing power of consumers.

Market research can help businesses decide, for instance, what benefits to re-emphasise and which claims have become stronger.

4. Test effectiveness of advertising

Advertising can strengthen brands, paving the way to lower price sensitivity for their products. But remember to test the ads before launching. This can prevent an ineffective campaign and, even worse, ads that cause a backlash.

What options do businesses have?

Below, find four ways that can help businesses navigate this inflationary environment:

1. Evaluate your product mix

During times of high inflation, it is useful to examine profitability by each SKU or service because:

- It allows brands to minimise cost by eliminating low-performing products.

- It helps identify products with inelastic demand or segments with low price sensitivity for price mark-up without sacrificing volume.

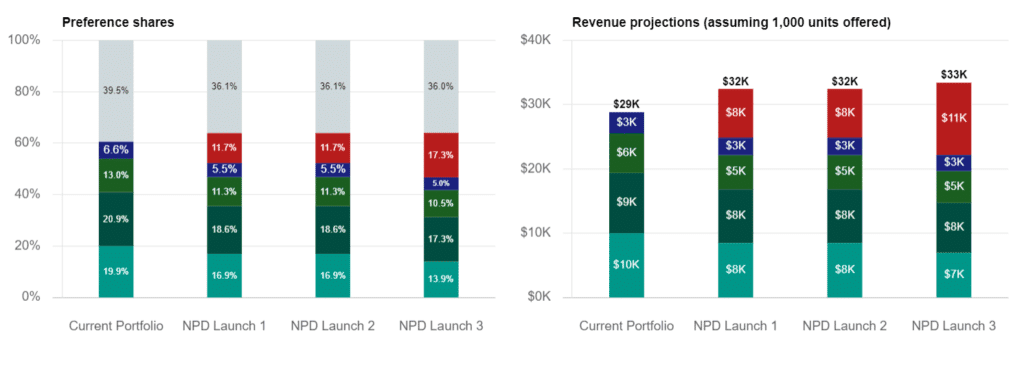

Research methods like conjoint analysis can take both considerations into account when simulating different portfolio scenarios:

2. Innovate and premiumise

Innovation allows businesses to launch premium offerings that deliver greater value to customers, and thereby avoiding negativity associated with simple price increases on existing products.

CONJOINT.LY

3. Communicate price increases (intelligently)

If you have to do a simple price increase, keep three things in mind when communicating price increases:

- Customers are more willing to accept temporary surcharges than permanent hikes.

- Customers are more willing to accept price increase when they are informed about the rationale behind the price change.

- Especially in times of inflation, consumers may have different needs and pain points. A single message may not be enough to appease all.

4. Solidify a positive brand image

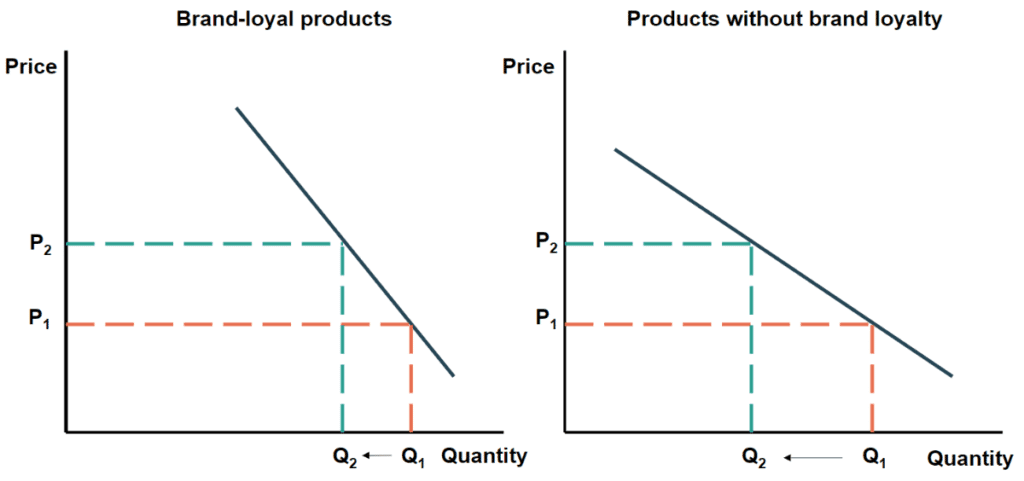

Taking the time to build a positive brand image allows businesses toimprove their brand loyalty among their customers. Improved brand loyalty results in higher brand power. Stronger branding can reduce the negative impacts of inflation on businesses as consumers are willing to pay more for branded goods.

Comments

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

Disclaimer

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.