Categories

March 13, 2023

5 Ways Research can Help your Company Weather a Downturn

Discover strategies to maximize the value of your research and stay ahead in challenging economic times.

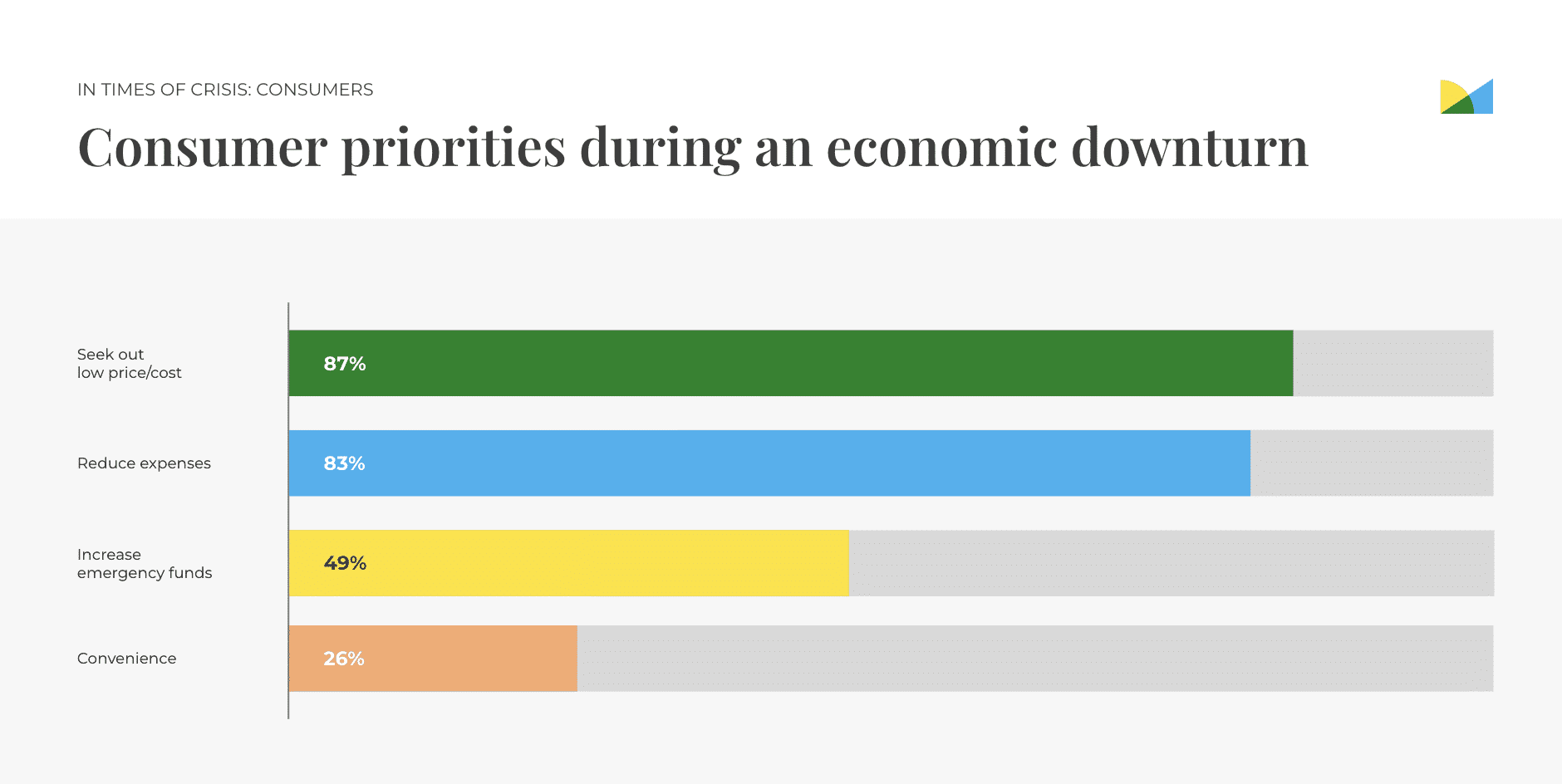

If there’s anything that these past few years have taught us, it’s that change is constant and the market is unpredictable. As the potential of a downturn looms, consumers are looking to spend less and business leaders are making decisions on tighter budgets. In our recent study, more than 83% of consumers will prioritize seeking out low cost products and reducing their expenses*. Understanding consumer behavior and how to pivot to the market will be crucial in weathering any downturn—that’s where research comes into play.

According to our study, 67% of business leaders believe that an economic downturn is the event that would have the biggest negative impact on their business**. But even as budgets are shrinking, market research takes priority; 85% of business leaders said that it would be risky to eliminate market research during a downturn, and nearly half conduct more market research during a time of crisis**.

The data is clear—market research is necessary for not only a business’s success during an impending downturn, but also its survival. Here are a few tips on ensuring that you’re getting meaningful insights from your research that you can act on.

1. Understand your customers and their shifting preferences

As you encounter unpredictable changes, you’ll want to keep track of how your core target markets are changing. The first step is to establish a baseline of consumer sentiment around your offerings. If you’ve been gauging customer trends and behaviors before the downturn, then you’ll already have a good grasp on what your customers expect from your brand and what they’re typically interested in.

In a downturn, consumer preferences may shift noticeably, so running usage & attitudes studies will help you gain a deeper understanding of how your consumers’ attitudes are changing. A study can also help you identify their behaviors and characteristics beyond demographics. This way, you can hone in on not only how to optimize your product offerings, but also which consumer segments to prioritize with the resources you have. But before you start making changes to your offerings, check in with your customers.

2. Gauge what’s important to your customers before pursuing a strategy

During a downturn, it’s necessary to re-evaluate your offerings to see if they still resonate with the market and economic conditions. At this point, you may already be coming up with strategies that optimize your products to follow market trends, create lower cost offerings, or pivot the messaging of your brand. However, don’t act based on instinct alone. An uninformed choice could lead to changing a product that customers really love or sending the wrong message to your key markets.

To maintain traction and momentum with your existing customers, make sure you’re gauging what’s important to them before making major changes. Test concepts, features, and messages that matter to your ideal market, as well as the prices that consumers are willing to pay.

3. Continue investing in your brand

When asked what would help a company weather a downturn, 52% of business leaders said an established brand reputation**. Building a brand that stands out, is relevant and aligns with consumer needs will improve loyalty and help you retain customers, even when the economy is weak. Needless to say, it’s important to ensure that your brand is perceived well in the market.

A brand tracker is a great tool to establish a baseline of where your brand stands. It will also help you identify how certain marketing campaigns affect your brand, and how key indicators like awareness, consideration, and loyalty have changed with any major events.

4. Run frequent pulse studies on market trends

Because so much is changing during a down economy, from lower spending habits to redistribution of business priorities, it’s crucial to be running frequent pulse studies. Optimizing your products in a downturn means following the market and staying on top of your consumers’ behaviors. As the market changes quickly, any data can be outdated in just weeks or even days. When ad and creative budgets get cut, this kind of data will offer direction for how to further develop products and business strategies.

Try to collect refreshed data every couple of weeks or days. At the latest, sample within 3 months. This way, you’ll have the data to anticipate any brand crises or market disruptions.

Bonus tip: When sampling, make sure the data collected is consistent with previous studies and trended data, so that you can accurately identify any major shifts in consumer sentiment.

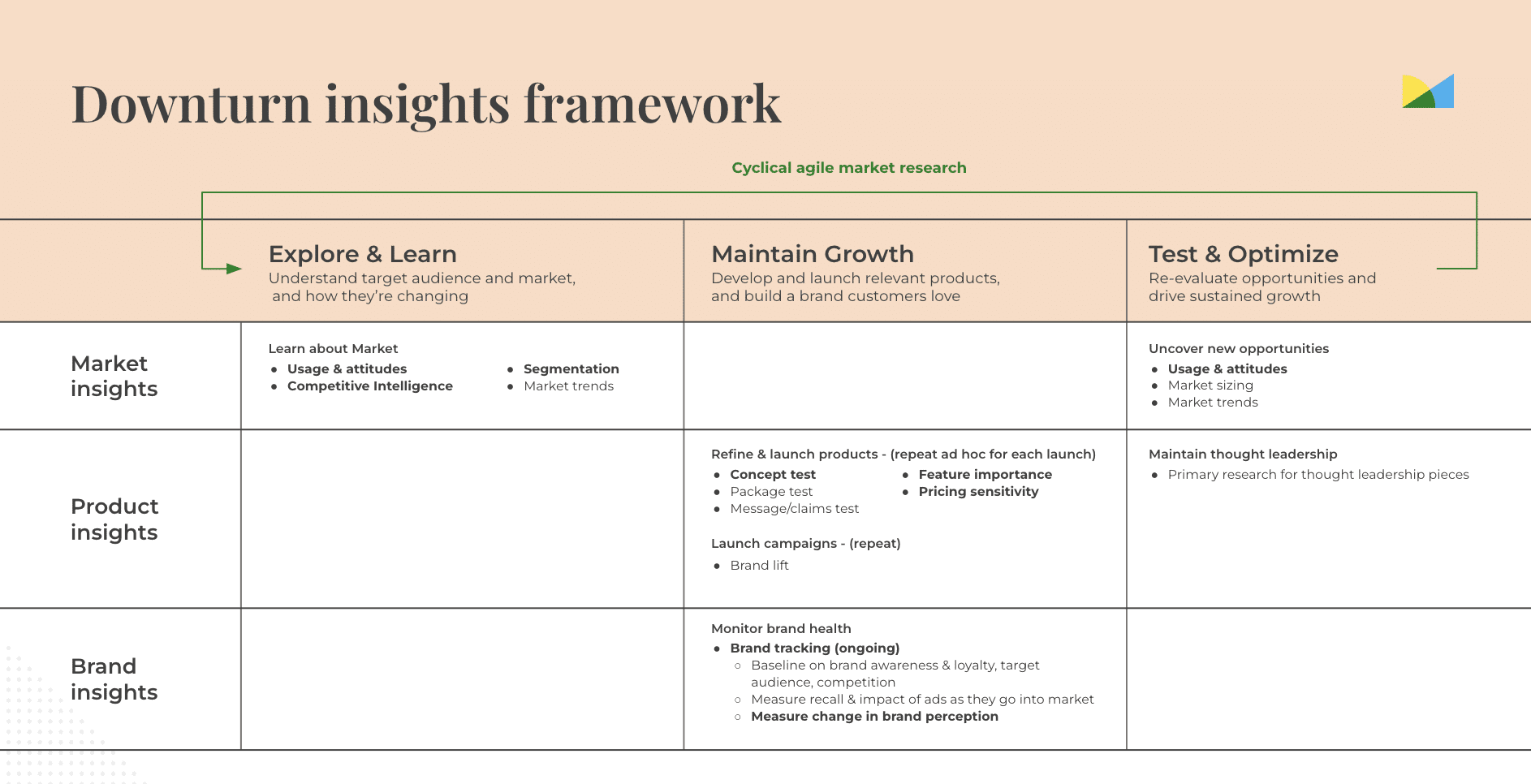

5. Set up an agile market research process

All of the market research you conduct should be done proactively rather than reactively, to get ahead of less than optimal economic conditions. The best way to accomplish this is by setting up a continuous market research process that can deliver meaningful insights fast. Your data should also build on other pieces of data rather than lying in silos, whether it’s CRM data or other market research, so that key leaders in your organization can act on synergized insights.

When you conduct research in a repeatable model, you’ll have the insights that guide strategies across the product or brand development lifecycle—whether you’re entering new markets, launching products or campaigns, or searching for new opportunities.

These are my 5 top tips for conducting market research to maintain growth in a downturn. These tips should help you gain valuable insights into your audiences, the market, and your brand, so that you can offer your key buyers what they need most.

*July 2022 Momentive study conducted using SurveyMonkey weighted for a national sample of 1,411 adult consumers.

**July 26, 2022 Momentive study conducted of 410 business leaders in the U.S. Data collected overnight. Respondents for this survey were selected from the more than 2 million people who take surveys on the using SurveyMonkey platform each day.

Comments

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

Disclaimer

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

More from Liwen Xu

3 Ways Sakura of America uses Agile Market Insights to Drive Consumer Led Innovation

Taking a successful product into a new market can be daunting—especially when it’s been designed for a specific audience. Sakura, a Japan-based art an...

ARTICLES

Top in Consumer Behavior

Ghosts of Holiday Research: What Past, Present, and Future Consumer Behavior Reveal

Unwrap how holiday behavior has changed from the 1950s to today’s tech-driven holidays and what insights pros need to prepare for next.

GEO, from Search to Answers: The Shifting Landscape of Digital Consumer Journeys

From Gen Z to Boomers, passive meter data uncovers how generations navigate AI and search differently in the new digital landscape.

TikTok Shop is the New Black Friday: Urgent, Addictive, and Changing How We Buy

TikTok is turning scrolling into spending. Holiday shopping intent on TikTok Shop jumped to 83% in 2025, blurring entertainment and e-commerce.

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.